Decisions in Financial Management

Liquidity | Cash flow management |

Investment | Whether and when to invest in which assets |

Financing | Structure of funds – debt/equity |

Profit distribution | Dividends |

Types of Financial Management

Liquidity/working K management | Monitoring of current asset and current liability ratios to ensure sufficient cash flow |

K investment – budgeting | Investment Decision Invest if NPV > 0 i.e. projected earnings > costs i.e. profitable Today’s value of future cash flows – today’s outlay |

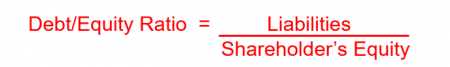

Financing – K structure and funding of investment | Financing Decision Debt or equity D/E ratio Gearing: Debt/assets |

Dividends or retain profits | Based on dividend policy (retain earnings or provide dividends, what amount and frequency) |

1. Investment Decision

A. Present Value

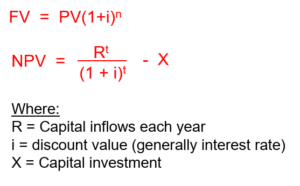

NPV: Difference between discounted capital inflows and outflows. Future value is discounted for risk and time value of money.

Time Value of Money: A dollar today is worth more than a dollar tomorrow due to the returns you can earn on it over time.

PV: present value of net future cash flows. The profit a project generates in today’s dollars.

Net: Difference between capital inflows and outflows.

Even if one project has greater returns, another may have a higher NPV if the returns are generated sooner.

Invest if NPV > 0

Excel formula:

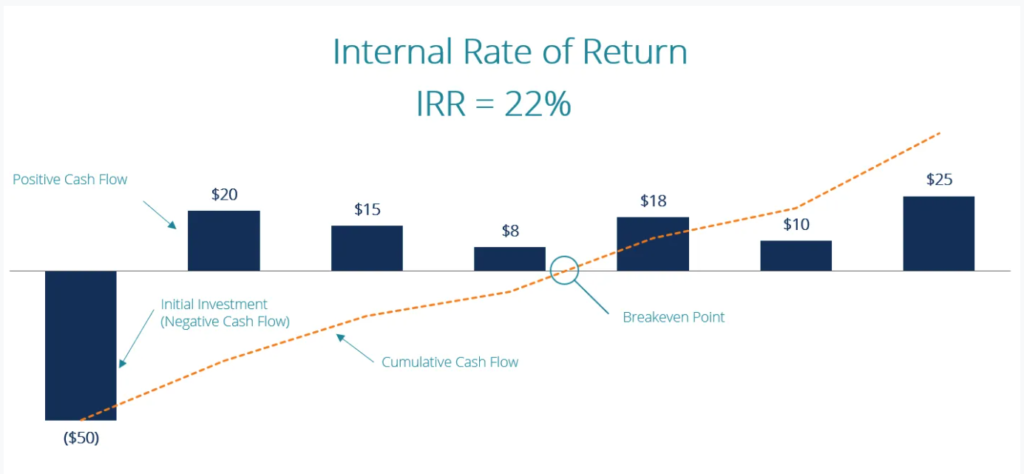

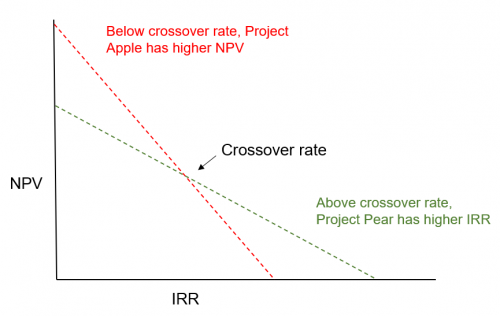

B. Internal Rate of Return (IRR)

IRR is the required discount rate/ rate of return that causes NPV = 0.

Compare this with a company’s target rate / minimum acceptable rate of return and IRR of projects with same duration.

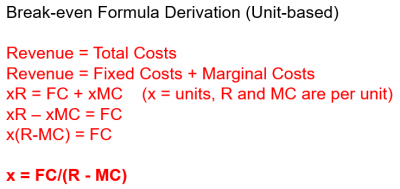

C. Breakeven Analysis

The break even point is:

- the time in years at which positive cash flow = negative cash flow

- the unit sales where revenue = total costs i.e. no profit or loss is made

D. Payback

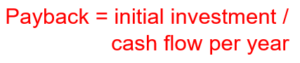

The payback period is the time taken to recover the investment / reach the break even point i.e. pay back the cost.

D. Other methods of investment evaluation

BCR: Benefit Cost Ratio

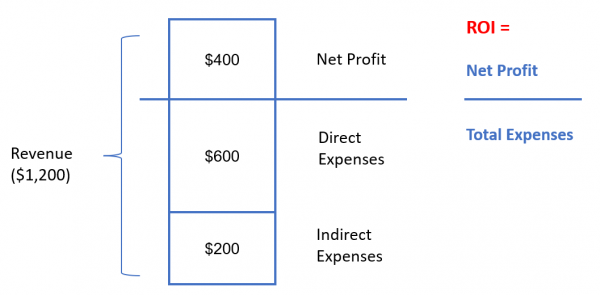

Accounting Rate of Return (ROI)

Profit / Investment

No DCF

Making the Investment Decision

Sensitivity Analysis

The analysis of return (e.g. breakeven) is multiplied by the variance level (e.g. +- 15%) on both sides, to give worst, base and best case outcomes.

Financing Decision

Leverage

Higher debt/equity ratio indicates insolvency risk

However, if returns/earnings > Debt repayments, earnings will benefit from the debt.