Financial Markets and Money

Money, as one type of financial asset, functions as:

- Medium of exchange

- Store of wealth

- Divisible

Types of Financial Institutions

Authorised deposit-taking institutions (commercial banks) | Government-licensed ADIs e.g. commercial banks |

Non-ADI financial institutions | Investment Banks – do not take deposits – they help companies raise capital |

Insurers and fund managers | Manage portfolios and risk |

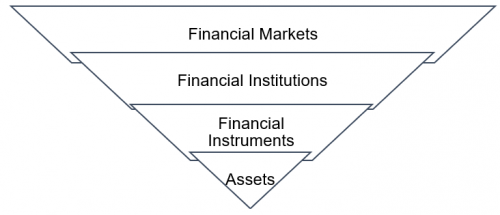

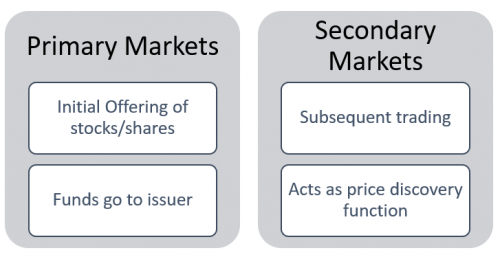

Types of Financial Markets

Retail and Wholesale Markets | |

Retail Markets | Direct flows of small amounts of funds between households, firms and intermediaries E.g. home loans |

Wholesale Markets | Large flows of funds between institutional lenders and borrowers E.g. Investment banks and IPOs |

Direct and Indirect Finance | |

Direct Finance | Direct between lender and borrower (often with help of broker) •Avoids costs of intermediation •However, costs of search and transaction costs (legal, advisory) incurred |

Indirect Finance | Finance undertaken through intermediary (e.g. bank) •Allows transformation and matching of assets and maturity •Economies of scale by spreading fixed costs •Risk management – intermediary exposed to borrower risk |

Off Balance Sheet transactions include: performance guarantees, underwriting, loan approvals, derivatives.

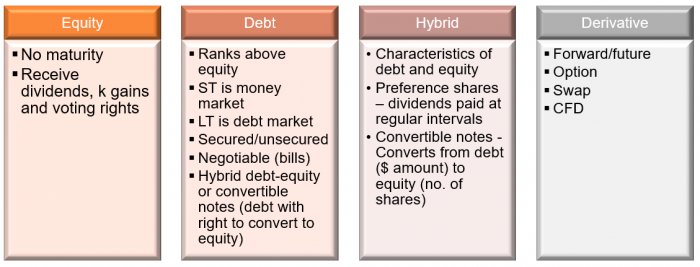

Types of Financial Instruments

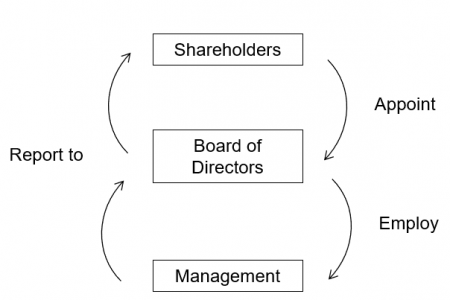

Corporate Governance