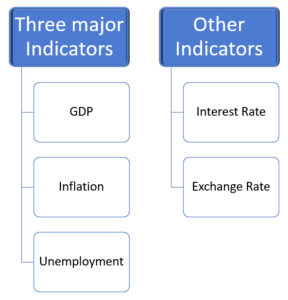

The indicators of economic performance give us a way to assess how an economy is performing. They are explored in turn below.

1. Gross Domestic Product - GDP

Nominal GDP | Unadjusted for price |

Real GDP | Adjusted for inflation |

Ways of calculating GDP: | |

GDP(P): | Production/value added at each step – Revenue less cost |

GDP(E): | Expenditure by Households, Firms, Governments and Foreign Sector |

GDP(I) | Income |

Other measures | |

GDP | Based on nation – includes foreigners, excludes residents overseas |

GNP | Based on people – includes residents overseas, excludes foreigners |

GNI | Based on payment flows – includes money spent in the country/repatriated |

2. Inflation

Inflation is the rate of change of the price of goods.

It is measured as change in CPI.

CPI = cost of goods in current year / cost of goods in base year

Inflation results from price levels rising disproportionately to quantity. See the long-run average supply in the long-run business cycle section below.

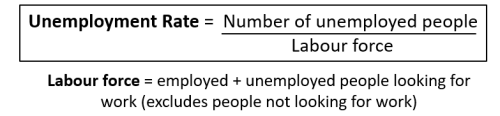

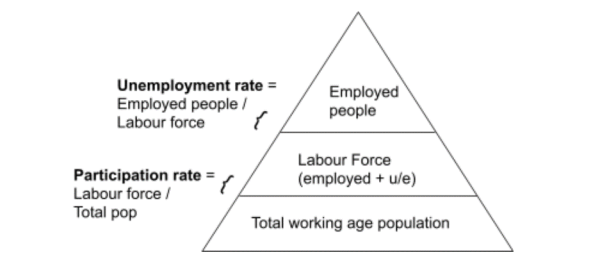

3. Unemployment

Types of unemployment

Frictional | People trying to find new jobs |

Structural | Skills mismatch |

Cyclical | Following the economy |

Wages and employment are determined by the supply and demand for labour in a given industry.

An industry with high supply and low demand will have lower wages.

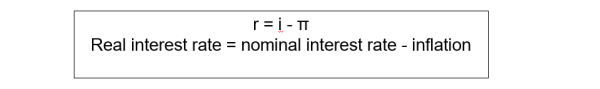

4. Interest Rates

Real Interest Rate | Reflects the real, economic cost of borrowing and return to lenders |

Nominal Interest Rate (advertised rate) | Incorporates compensation for expected erosion of value due to inflation. |

Central Bank Regulation of Interest Rates:

Central Bank tries to keep the real interest rate (r) constant by controlling the nominal interest rate (i) in response to inflation (π)

- If (π) increases, central bank increases (i) so as to not erode (r)

- If (π) decreases, central bank reduces (i) so that (r) doesn’t increase (this would increase saving)

5. Exchange Rates

Calculating the Exchange Rate

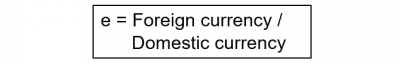

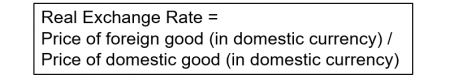

- The nominal exchange rate is the price of foreign currency over the base currency.

- The base currency is taken to be 1, so the exchange rate tells you how many units of the foreign currency can be bought by one unit of domestic currency.

- Appreciation is where one unit of base currency buys more of foreign currency. E.g. USD/AUD going from 0.7 to 0.8 means the AUD is getting stronger.

Currency markets are subject to demand and supply forces and influenced by:

- Interest rates (higher creates more demand)

- Favourabilty of investment opportunities

- Speculation (if investors expect a currency to depreciate, they will sell it) and it’s value will reduce

Types of Indicators

Leading | Observed before economic activity, often reflects expectations (e.g. optimism) | Consumer confidence, housing approvals |

Coincident | Observed at same time | GDP/ income |

Lagging | Observed after economic activity, often firms take time to respond | Unemployment |