Balance of Payments

A nation’s balance of payments comprises the current account and capital account.

- The current account represents the net income / flow of money (like a P&L)

- The capital account represents changes in assets and liabilities (like a balance sheet)

The Current Account balance and Capital Account balance offset each other

i.e. CAB = – KAB

i.e. CAB = – KAB

Capital Flows

Current Account | Net income (short-term)

|

Capital & Financial Account | Net investment and financing

|

Current Account and Savings/Investment

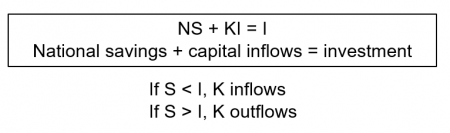

- In a closed economy, S = I

- In an economy open to world trade, net capital inflows make up the difference

- If the trade balance (exports less imports) is positive, i.e. surplus, the country is a net lender (financing needed to overseas buyers) so there are net capital outflows.