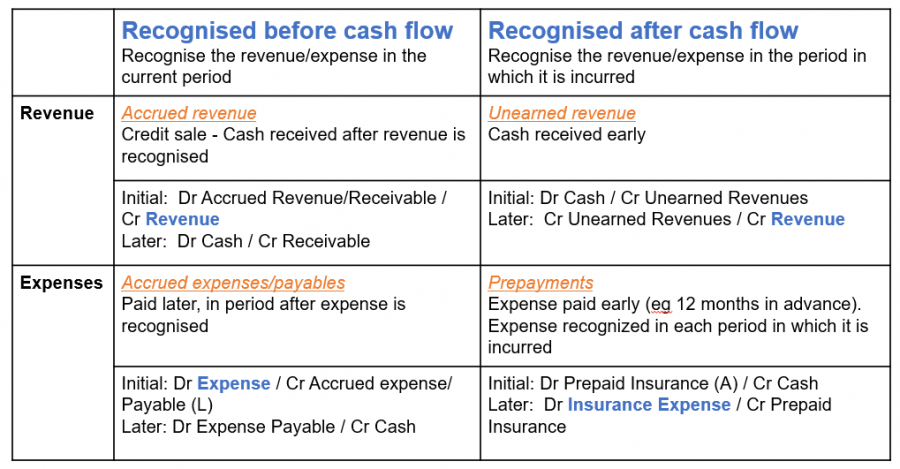

Accrual Adjustments

The management team of a business runs the day-to-day operations and need to know how the P&L is tracking on a regular (weekly or monthly) basis.

In accrual accounting, revenue and expenses are recognised when they are incurred, not when they are paid. Asset and liability accounts are used to recorded transactions which don’t match cash flow, so that revenue and expenses are recognised when the revenue is generated or the expense is incurred – so that the P&L is accurate.

Capitalisation

To expense – upfront cost

Capitalise – add to liability to pay over time

To “capitalise” an asset means to account for capital expenditure across periods throughout the useful life of the asset. You would record it on the balance sheet as an asset instead of on the income statement as an expense. It is expensed (depreciated/amortised) on a yearly basis. The entry is:

Dr Asset account / Cr Cash

At the end of the period, the entry would be (the calculated value of depreciation, below)

Dr Depreciation expense / Cr Asset

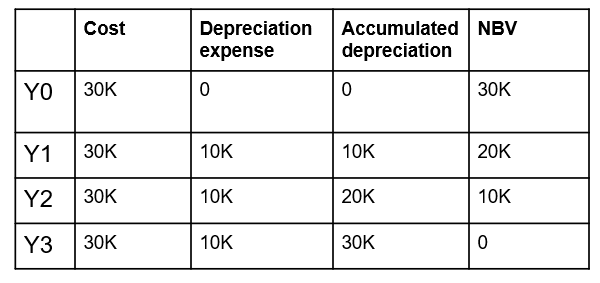

The balance sheet carries the net book value (NBV) each year – the cost less accumulated depreciation.

Classification of an item as an Asset or Expense is based on:

- Expected to yield future economic benefits (contributes to cash flow)

- Flow of benefits is controlled by the entity

- Purchased or obtained through a past event

Depreciation

To determine depreciation, you need:

- Useful life

- Flow of benefits (straight-line, reducing balance or unit-based)

- Residual value

Intangible Assets and Amortisation

Goodwill is internally generated and only measured upon sale. Calculated as sale price less fair value of net assets.

Intangible assets are amortised instead of being depreciated.

Impairment

The market value of an asset is below its book value and needs to be written down. Assets are tested for impairment at each reporting date (generally every year). Whereas depreciation is regular, expected reduction in asset value, impairment is unexpected reductions in value. A company must test assets for impairment each reporting period. Impairment could be from:

- Significant decline in market value e.g. from changed conditions

- Damage to physical asset

- Disposal plans

This is done by the entry:

Dr Impairment expense / Cr Asset

Contra Accounts

Contra-accounts are negative asset accounts (credit balance) rather than a liability. They reduce asset accounts.

Accumulated Depreciation – reduces the Asset account

Provision/Allowance for Doubtful Debts – reduces Accounts Receivable. Estimated as % of Accounts Receivable or % by days outstanding.

Note: a provision is recorded when it is probable that there will be outflows. When the liability is dependent on future events, it is disclosed as a contingent liability in the balance sheet.

Accounting Standards

AASB – Australian Accounting Standards Board

IASB – International Accounting Standards Board

GAAP – Generally Accepted Accounting Principles

IFRS – International Financial Reporting Standards

Businesses can choose to use historical model or revalued model to record carrying amount of A/L.

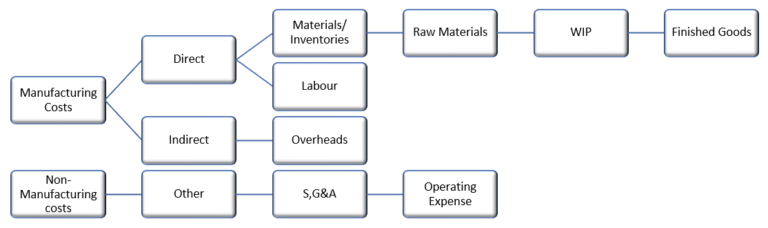

Cost Classification

A) Functional

Finished Goods amounts to Cost of Goods Sold (COGS)

COGS = Opening Inventory + Purchases – Closing Inventory

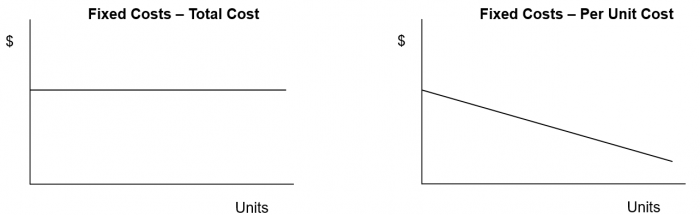

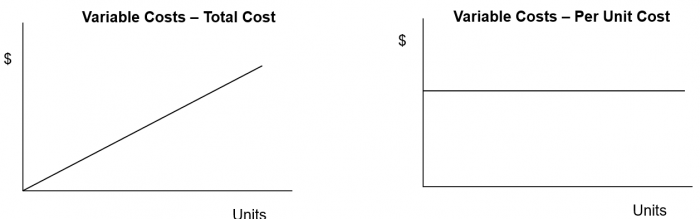

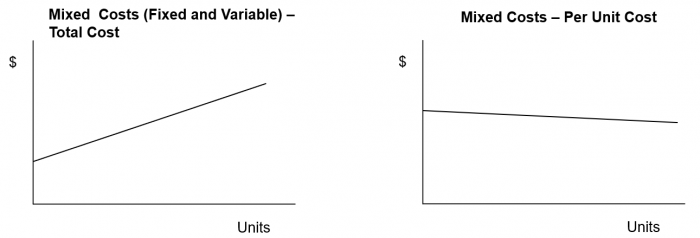

B) Behavioural - Fixed and Variable Costs

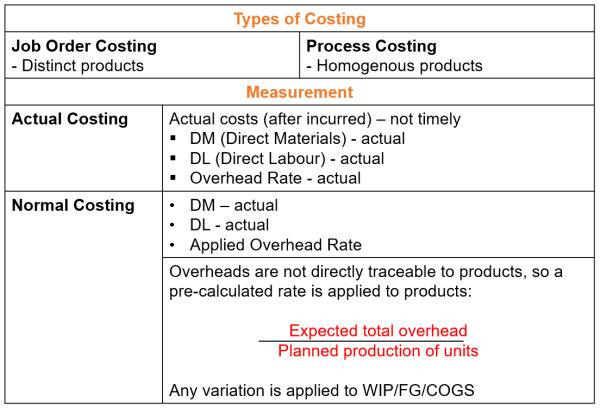

Types of Costing

Asset Valuation

Purchase Cost Recognition | |

Purchase price | Including taxes and duties |

Costs of brining asset to location and being in condition to operate as intended | Import duties, installation, delivery, Dismantling and remediation |

Carrying Value | |

Cost Model | Cost less accumulated depreciation and impairment (unexpected drop in value) |

Revaluation Model | Fair value less accumulated depreciation |

Asset Valuation | |

Historical Cost | Acquisition cost |

Price-adjusted Historical Cost | Acquisition cost adjusted for inflation (what is purchase price in today’s dollars)? |

Realisable Value | Liquidation value – urgent sale price (less than market value) |

Present Value | Discounted value of future cash flows |

Market Value | Price at which asset would change hands between seller and purchaser both under no compulsion to buy |

Fair Value | Fundamentally-derived worth of the asset |