Components of Financial Statements

Income and Expenses (flow) | Increase or decrease in economic benefits |

Asset and Liability (static) | Resource or obligation (current if < 1 year) |

Equity | Residual interest in assets of the business |

Asset | Liability |

Future inflow of economic benefits | Future outflow of economic benefits |

Present economic value | Present obligation |

Result of past transaction | Result of past transaction |

Current Asset/Liability: economic benefits or obligations due within 12 months | |

Types of Financial Statements

Special Purpose

General Purpose

Intended for presentation to a limited group, such as regulators, banks or industry bodies.

Intended for stakeholders not in a position to request financial statements tailored to their specific needs.

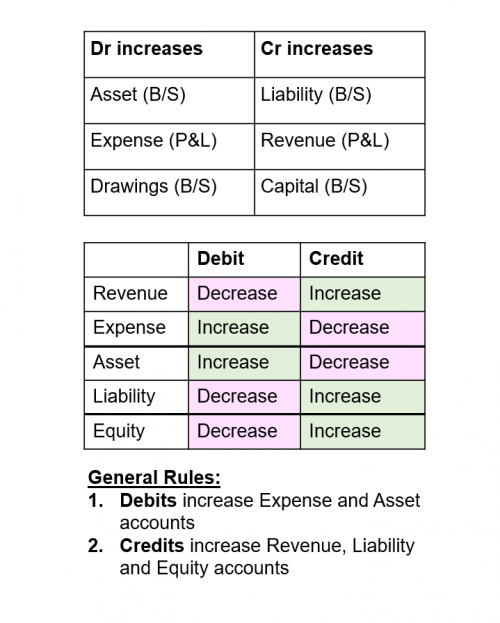

Debits and Credits

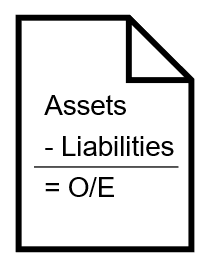

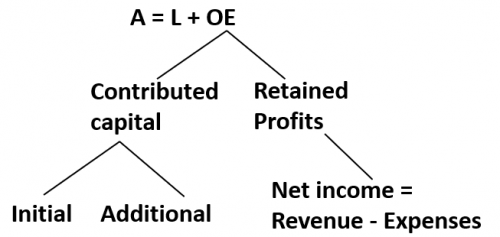

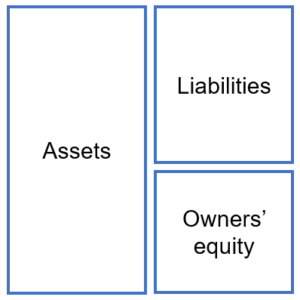

The Accounting Equation

The Accounting Equation is a representation of the Balance Sheet, which shows that:

- net assets are funded by equity, or

- liabilities and equity fund total assets.

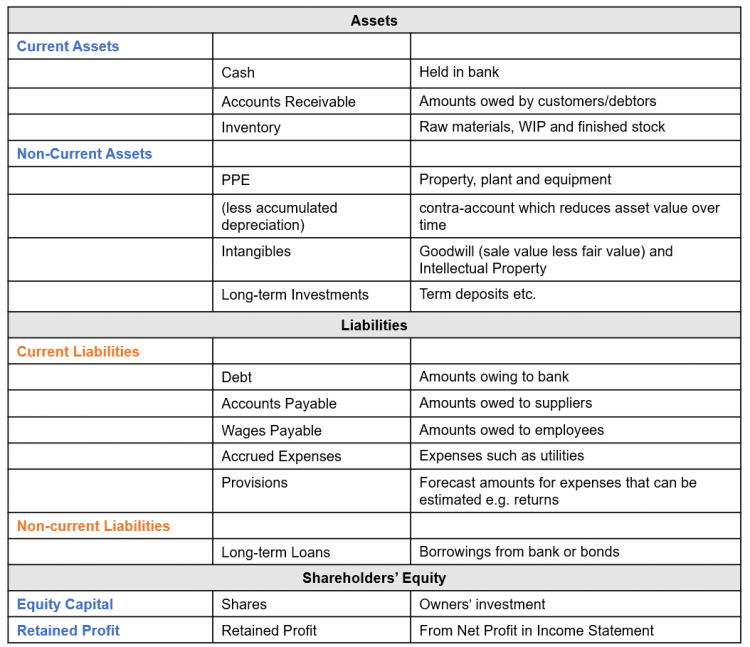

1. The Balance Sheet

The Balance Sheet is the formal presentation of the accounting equation. It represents the financial position of the company at a point in time. Net Assets should equal Equity.

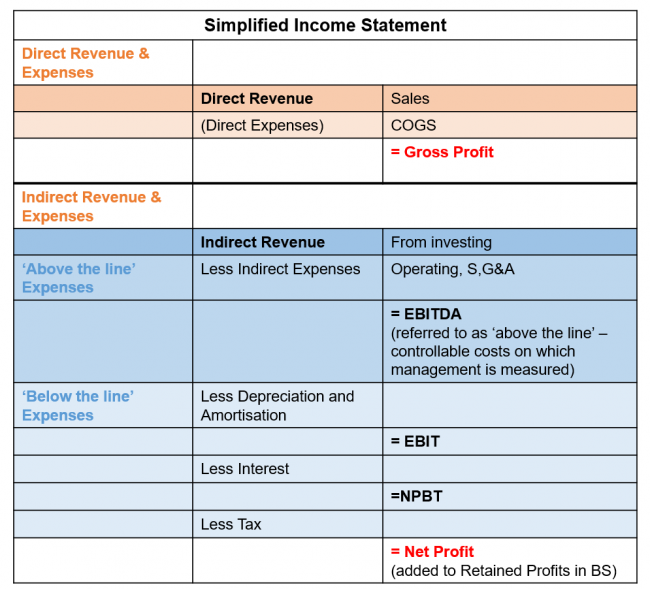

2. The Income Statement / Profit & Loss Statement

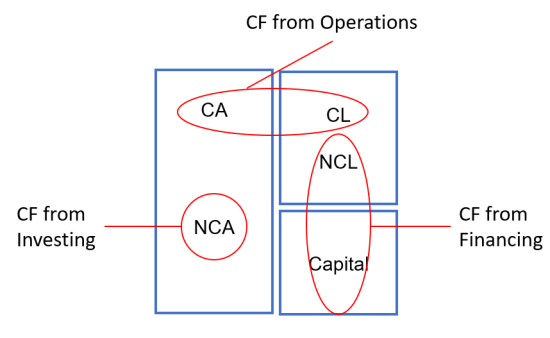

3. The Statement of Cash Flows

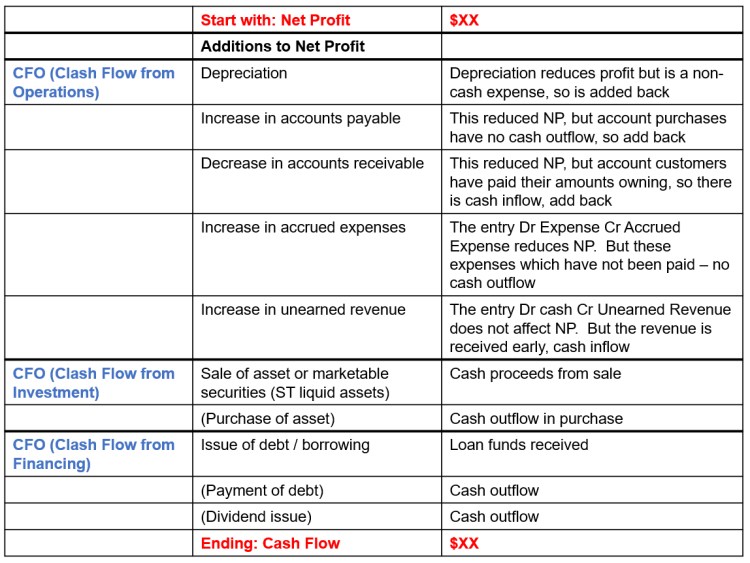

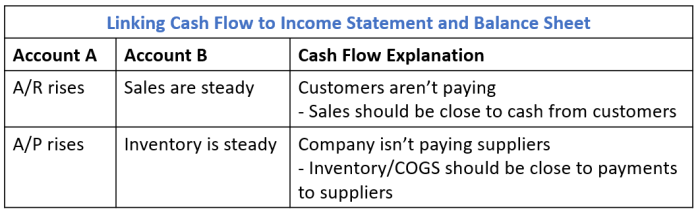

The Cash Flow Statement is a reconciliation between profit and cash. Net income on the Income Statement is done on an accrual basis. Profit however, doesn’t pay bills. Cash flow tracks solvency.

The direct method involves listing the cash inflows and outflows – however, this involves keeping detailed cash records so is not often used.

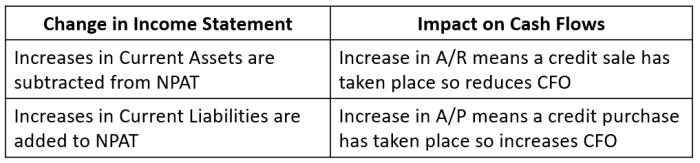

The more common indirect method starts with Net Profit and applies adjustments for cash receipts and disbursements to arrive at cash. The ending cash balance equals the cash account in the balance sheet.

It has three components:

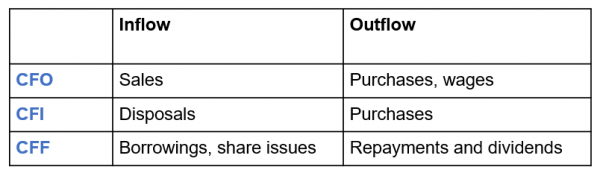

- CFO (Cash Flow from Operations): Main income-generating activities of a business and cash flow from current assets and current liabilities

- CFI (Cash Flow from Investment): purchase and disposals of non-current assets and securities such as PPE. This is capital expenditure

- CFF (Cash Flow from Financing): Cash flow which affects equity or borrowing.

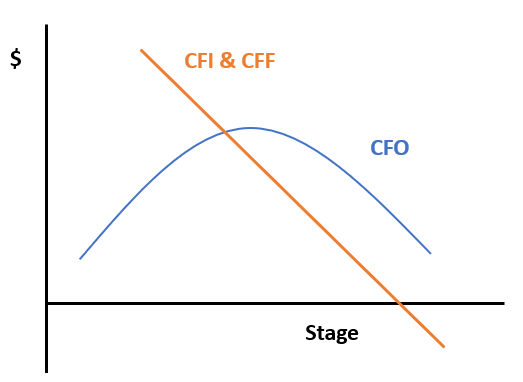

Cash flow in business phases

Early stage / Startup | Low CFO, high CFI and CFF |

Mature / Stable | High CFO, low CFI and CFF |

Decline | Low CFO, negative CFI and CFF (sell assets and repay debts) |

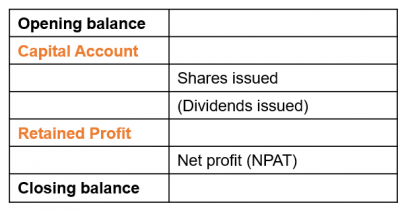

4. Statement of Changes in Equity