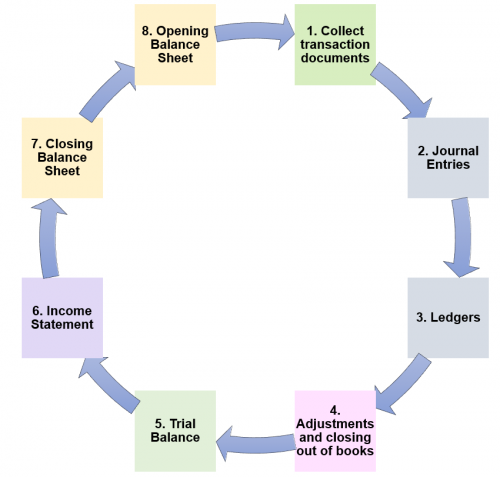

The Accounting Cycle

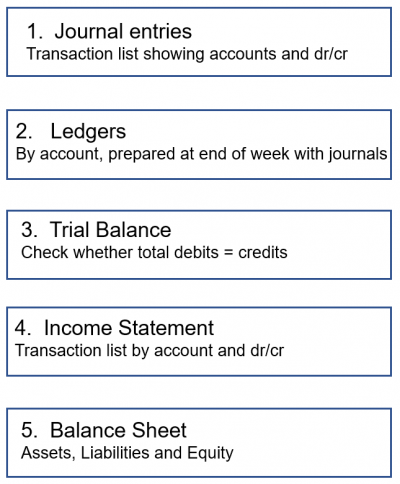

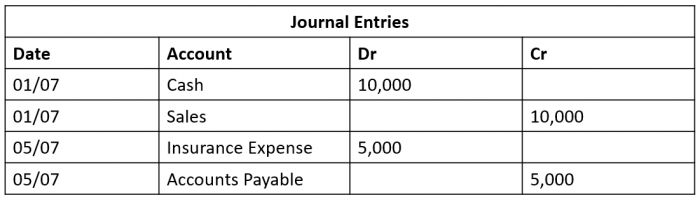

Journal Entries

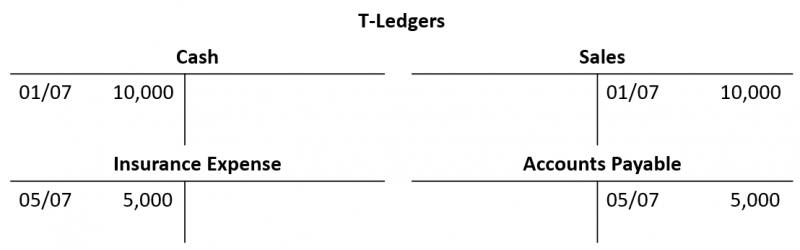

T-Ledgers

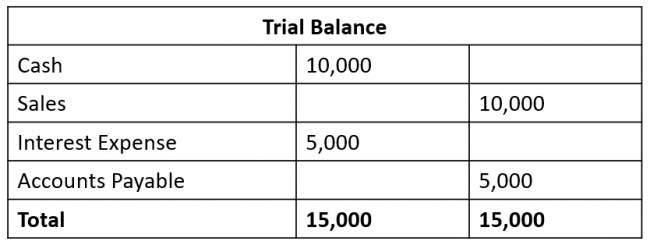

Trial Balance

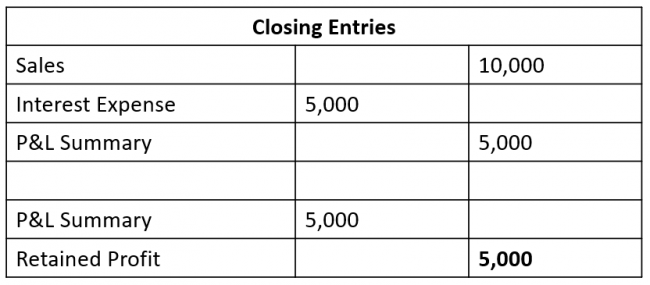

Closing Entries

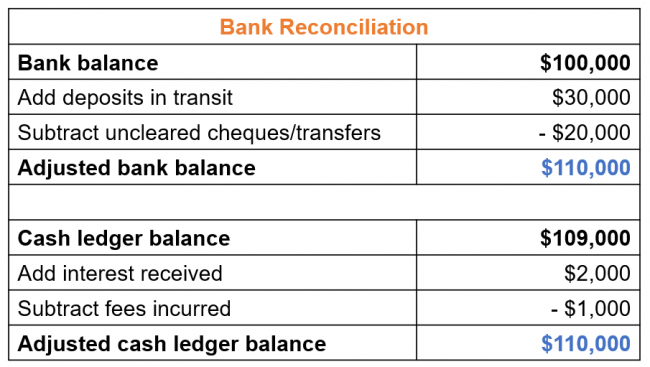

Bank Reconciliation

Comparison on balance in bank statement with cash ledger account.

Adjust bank statement balance for deposits in transit, outstanding cheques and bank errors.

Adjust cash account for bank fees and charges and interest.

Month end processes

- Correction of errors – in ledger and journal entries

- Adjustments – e.g. prepayments, accruals, depreciation

- Reconciliation – of balance sheet accounts to bank

- Close accounts – through trial balance

- Reporting to management

Accounting Software

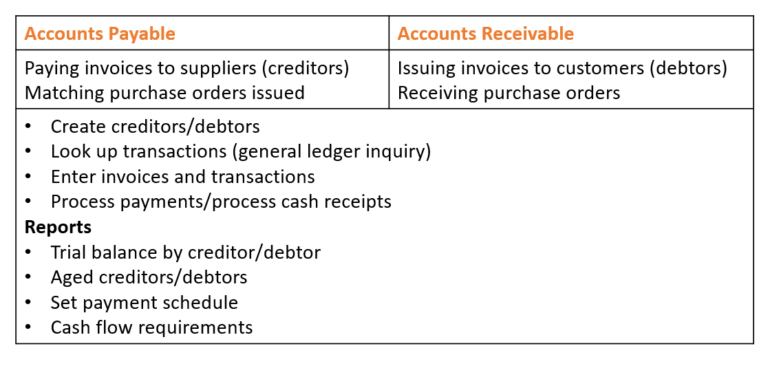

Accounts Receivable and Accounts Payable