Investing in Stock/Share Markets

- Market

- Securities Trading System

- Clearing and Settlements

- Regulation

Investing vs Trading

Investing: Purchasing and holding financial assets for the long-term, to benefit from growth.

Trading: Frequent buying and selling to make profits. Trading is also good for investors as it increases overall liquidity in market and increases likelihood you will find a counterparty.

Types of Markets

Dealer – OTC, market-maker: Dealer acts as counterparty for buyer and seller and quotes bid-ask prices.

Common in bond and currency markets.

Most liquid type of market

Broker: finds counterparty for buyers and sellers

Common for IPOs

Exchange-traded: Automated broking, trades executed based on order books.

Investment Strategies

Approaches | |

Value | Investing in established companies that have been profitable over a period of time and offer dividends |

Growth | Investing in companies that show potential for future growth |

Direct Investment | |

Buying and selling stocks | Purchase of individual stocks |

Indirect Investment | |

Active | Fund manager actively picks stocks (e.g. REITs) |

Passive | Fund which tracks and index (e.g. ETFs) |

Fundamental and Technical Analysis

Fundamental Analysis – what to buyFinding a stock’s intrinsic value | |

Qualitative |

|

Quantitative |

|

Technical Analysis – when to buy | |

Approach | Use of asset-specific price and trading activity such as charts |

Uses | Used by day traders (short-term) |

Fundamental Investment Analysis

Approaches

Time-series Analysis | Comparison of a firm with itself over a period of time |

Cross-sectional Analysis | Looking at different companies within an industry at different points in time |

Benchmark | Comparison against industry norms |

Techniques

Comparative Analysis | Comparison of financial statements of a company to identify trends |

Common Size Analysis | Analysis of items within financial statements -Income Statement items are reported as % of revenue -Balance Sheet items are reported as % of assets |

Ratio Analysis | Ratio of two or more items on financial statements |

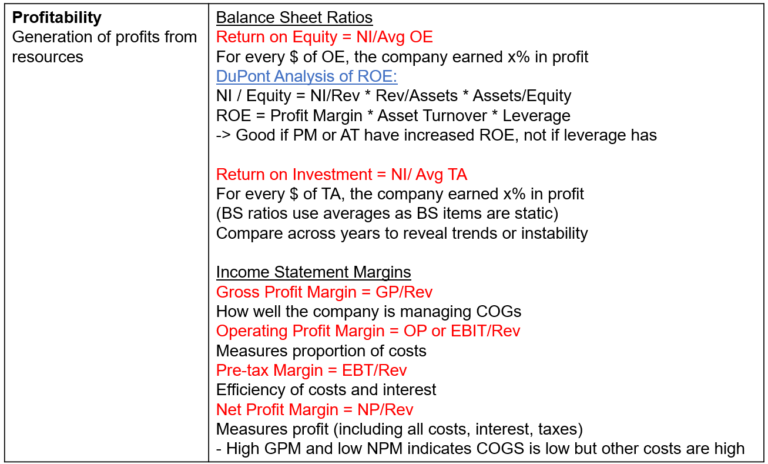

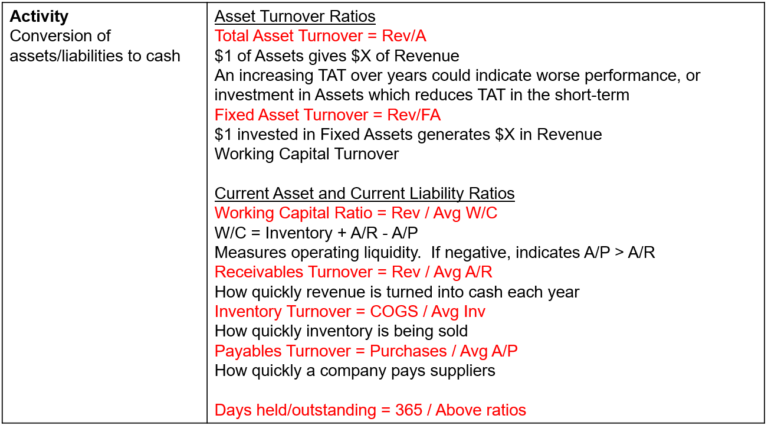

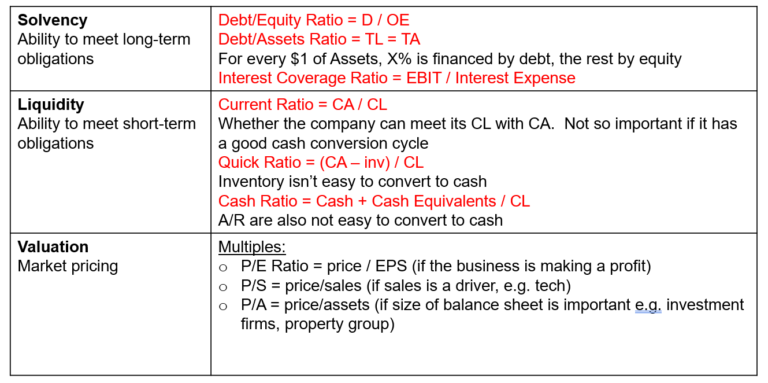

Financial Analysis Ratios

Managed Products

Exchange-traded Funds (ETFs) | Diversified portfolio of shares |

Real Estate Investment Trusts (REITs) | Diversified interest in real estate |

Infrastructure Funds | Diversified interest in infrastructure projects |

Derivatives and CFDs | Derive value from underlying asset, some highly leveraged |

Risk and Return

Risk and return are major considerations in the investment decision.

Return is measured by expected value – the outcomes weighted by their probabilities, and the risk is measured by standard deviation – the distribution of returns from their mean.

Return

Return = Income (dividend) + capital gains

Rate of Return = Return / Purchase price

Expected Return

However, we don’t know future payoffs, so look at Expected Return, based on probability of payoffs

Expected Value = Outcome x Probability

EV = P(A(%)) * Outcome A + P(B)[100%-P(A)]

Risk

Variance – Distance from mean squared

Var = x – [mean of x]

Standard Deviation – Squareroot of Variance, or avg distance from mean

SD = √ Var

Portfolio diversification

Good performing assets offset badly-performing ones.

Generally, high risk leads to high returns, but not for risk due to non-diversification.

Diversify through:

- asset class – fixed income, shares, alternate

- size – small, mid or large cap

- industry

- defensive/growth assets

Systematic risk | Relating to whole market or economy – cannot be reduced through portfolio diversification (“beta”). |

Unsystematic risk / | Relating to specific share/company – asset-specific risks, which can be reduced through portfolio diversification, up to a point (also known as “alpha”). |

Asymmetric bet: upside is very different to downside

Standard and Alternative Investments

Standard Investments | Alternative Investments |

|

|

Derivatives

Definition – Financial instrument whose value is derived from an underlying asset Purpose – to manage risks of price fluctuations Example – Farmer locks in price of wheat sale now to protect against risk of currency downturn. Underlying asset (wheat) is sold and physically delivered separately Uses – Hedging and speculation | |

Exchange-traded | Standardised and traded on an exchange |

Over-the-counter | Non-standardised and negotiated and traded directly between buyer and seller |

Types of Derivatives | |

Future | Agreement to buy physical asset (commodity, energy or metals) at future date for specified price. Exchange-traded. Forward – OTC (direct between parties) |

Option | Right to buy or sell commodity at future date for specified price Buy – call (spot price > strike price) i.e. buy at strike price Sell – put (spot price < strike price) In-the-money: Exercised within the above rules Out-of-the-money: The rules are not met, so option is useless Covered: satisfaction of option is guaranteed Naked: no guarantee it will be completed |

Swap | Agreement to exchange cash flows from underlying assets |

CFD | Contract-for-difference: Exchange of the difference in value of underlying asset between contract open and close dates |

Hedging using derivatives involves entering into two contracts:

- Contract to buy or sell the underlying asset

- Contract for futures

Derivatives Trading

Margin Requirements | Trading platforms require a percentage of the sale price to be posted in advance to make sure buyers and sellers can wear losses |

Long Position | Investor owns the asset – expecting its value to rise (bull market) |

Short Position | Investor sells an asset which it has borrowed – buy later at a lower expected price (bear market) |

Call | Option to buy |

Put | Option to sell |

Open Position | A trade that has not been closed |

Closing out a contract | Reverse the contract by entering into opposite position – e.g. sell long position or buy asset in short position |

Objectives/Strategies | Hedge – reduce risk in price fluctuations Speculate/Trade – aim to make profit from price fluctuations (instead of capital gains e.g. shares) Arbitrage – take advantage of price differentials |

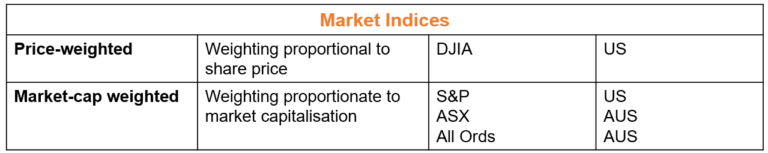

Indicies

Efficient Markets Hypothesis

Stock/share prices reflect all available information. They trade at their fair value – are not under- or over-valued. Therefore, there can be no arbitrage and investors cannot outperform the market in the long-term. | |

Strong Form | Public and private (insider) info is reflected in stock prices |

Semi-strong Form | Historical and current public info is reflected in prices (current/new info is quickly assimilated) |

Weak Form | Only historical public info is reflected in prices |

Implementation

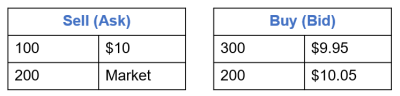

Bid-Ask Prices

Bid Price | Maximum an investor is willing to pay (below market price) |

Ask Price | Minimum a seller is willing to accept (above market price) |

Spread | Difference between bid and ask prices |

Types of Orders

Market Order | Order to transact immediately, at or around market price. |

Limit Order | Order above or below a specific price. Once the price is reached, it becomes a market order.

|

Order Book

Spread | Ask – Bid |

Price Impact of Order | Fulfilment of orders changes the best ask/bid prices |

Order Aggression | Closer to best price |

Partial Fulfilment | Order may be partially filled if not all shares can be matched |

Dollar cost averaging: spreading investment out rather than investing as a lump sum, to reduce risk of investing at the wrong time.

However, it doesn’t work well if the market price is rising – the average cost will increase.

It can also lead to a lot of brokerage fees being incurred.

Dividends

Frequency | Usually half-yearly (interim dividend) and yearly (final dividend) |

Ex dividend Date | 4 days prior to Record Date – only shares purchased before this date are eligible to receive dividend, otherwise later purchase share “cum dividend” |

Record Date | Date the company closes share register to assess eligibility for dividend (i.e. registration paperwork must be finalised) |

Price Implications | Usually share price increases prior to ex dividend date, then reduces by amount of dividend |

Short-selling

|

Long |

Buy shares and place stop-loss order |

|

Short |

Sell shares and place stop-loss or market order |

|

Trigger price |

Price at which stop-loss or market order is triggered, execution price may be different |

Liquidity

Immediacy | |

Width | |

Depth | Number of shares that buyers and sellers are willing to trade at each price. |

Resiliency |

Transaction Costs

Explicit | Brokerage fees, taxes |

Implicit | Spread, opportunity cost |

Monitoring

|

Benchmarking |

Use indexes to benchmark your investments (compare performance over the same period) |

|

Rebalancing |

Make changes if the asset allocation has changed over time |