Short-run: Involves expansions and contractions

Long-run: Shows increases in GDP

The Short-run Business Cycle

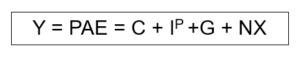

Aggregate Expenditure Model

- Assume – when there are output gaps, in the short-run, firms change output, not prices (menu costs like advertising, packaging, legal) – Keynes

- When Y does not equal PAE, there is an output gap (i.e. expenditure/demand is not met by anticipated demand)

- Firms change output by affecting the level of inventory they hold.

- In the short run, output changes; in the long run, prices change

Inventory

- IP – Planned Investment

- I – Actual Investment. If expenditure by consumers decreases, inventory held increases and investment (purchase of inventory) increases.

- The difference is the change in output that firms make instead of prices

Consumption, savings and investment

- C = exogenous C + c(Y-T)

- Consumption is both dependent on income and net government transfers, and exogenous consumption

- S=I

- Savings equals investment in a closed economy

Fiscal Policy

- Governments can influence output through G, T and t (government spending, transfers and taxes)

- To reduce a contractionary gap, increase G or reduce T

- Automatic stabilisers – reduction of Y means less taxes and more transfers (they are proportional to T), which increases spending

The Long-run Business Cycle

Aggregate Demand / Aggregate Supply (AD-AS Model)

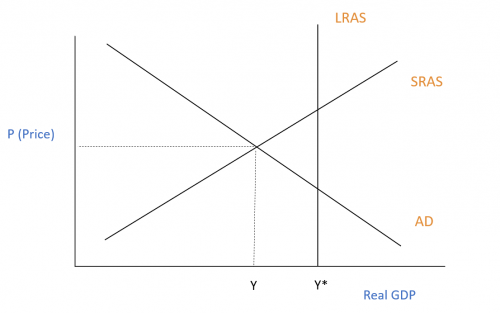

In the Keynesian short-run model of the economy, firms change output in the short-run.

In the long-run AD/AS model, firms change price, not output.

Long-run Average Supply

The AE or AD/AS model is the total spending for an economy, not an individual market (micro)

- LRAS is perfectly inelastic as firms adjust prices, not quantity. In the long-run, the profit incentive from adjusting output to the difference between prices and variable costs disappears.

- Increased demand results in increased prices while quantity stays the same. This causes inflation.

Output Gaps

- Take Y as short-run output and Y* as the long-run potential output at full employment (i.e. no cyclical unemployment)

- If Y* > Y, SR GDP is less than the economic potential (recessionary gap / contraction).

- If LRAS is to the left of short-run equilibrium, Y* < Y (expansionary gap).